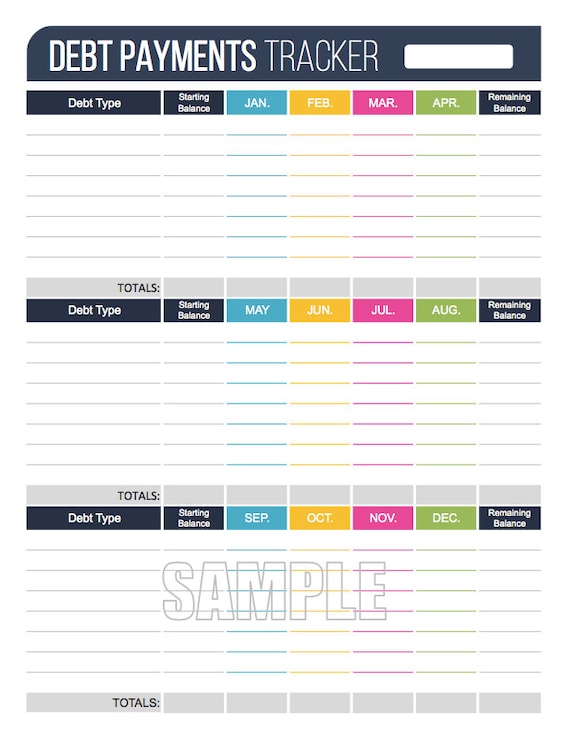

Debt worksheet in finance organization kit. Of that $6.1 trillion, over $4.4 trillion was financed by federal revenues. Credit card debt payoff plan and tracker. Web mrsneat® | printable and digital planner templates. Use my free printable debt snowball worksheet to get started!

We can’t help but recommend our own debt snowball worksheet ( you can download it for free here) as a great option if you’re looking to track your debt payoff journey. The set includes a debt overview sheet, a debt payoff tracking sheet, and a debt thermometer to give you a visual of your progress as you are working on paying off your debts. Ebill · online application · renters · home equity Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. Web this debt amortization calculator will show you just how much money you could be saving by increasing your payments on a particular debt.

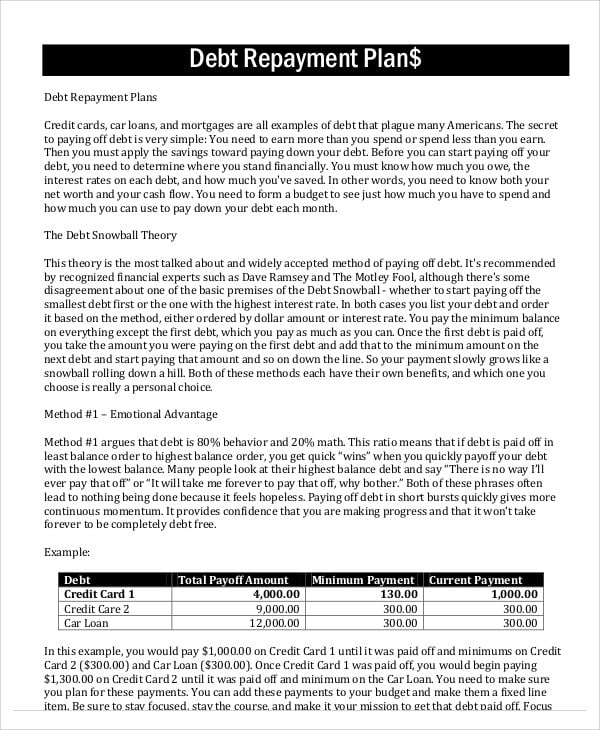

Top 5 tips for paying off debt printable. Debt payoff master plan and tracker. Automate both your minimum payments and the extra payment you’re making towards whichever debt you’re prioritizing first. Web the first step in creating a plan to pay off debt is to calculate what debt you have, what you owe, and how much you owe. Of that $6.1 trillion, over $4.4 trillion was financed by federal revenues.

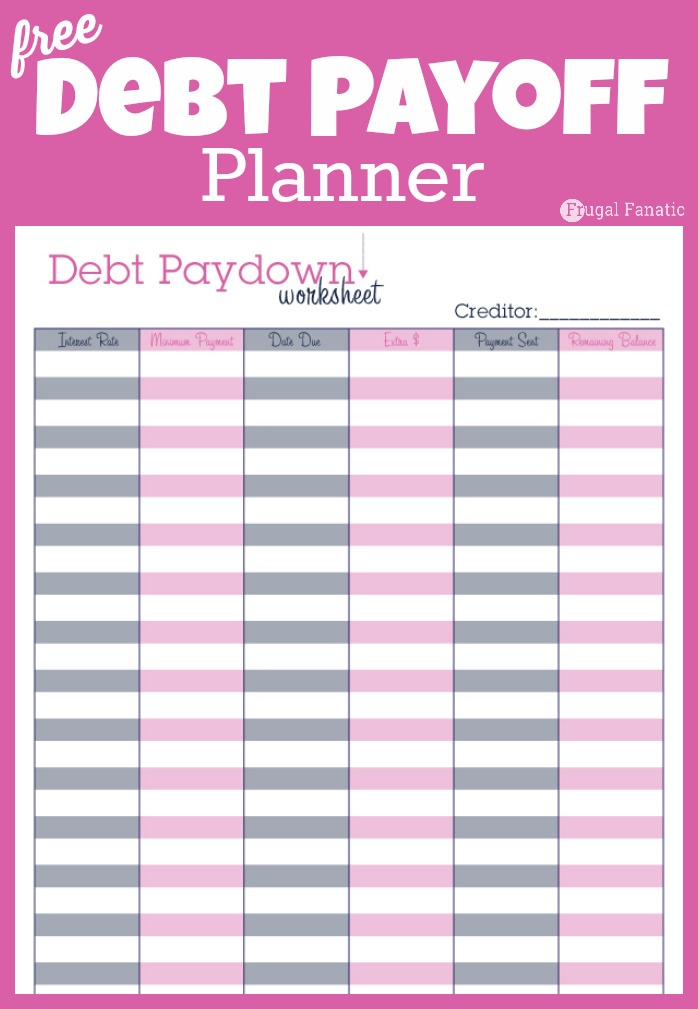

Pick up our free printable debt payoff worksheet pdf. If you don't pay much attention to the debt you have,. First enter the current principal balance owed and its attached interest rate. Easily track your progress on 10 different debts with 10 different colors on an a4 sized template. Web download the spreadsheet and follow the steps above to create your initial debt repayment plan. Here are two different debt payoff printables with proven methods and a step by step tutorial that actually works! Create a plan using a debt reduction spreadsheet. All pages are 100% free. Web want to pay off your debt? Debt payoff master plan and tracker. Top 5 tips for paying off debt printable. You can use the paymentschedule tab to figure out exactly what those amounts should be. It’s never easy to tackle debt, but having a clear plan in place can make it a whole lot more manageable. Circle any debts in collections. Credit card debt payoff plan and tracker.

Top 5 Tips For Paying Off Debt Printable.

Of that $6.1 trillion, over $4.4 trillion was financed by federal revenues. Web perhaps the best way to pay down your debt is with the debt snowball method! Debt payoff master plan and tracker. Ebill · online application · renters · home equity

You Can Either Print It Or Fill It In Online As A Pdf, So It Works No Matter Which Format You Prefer.

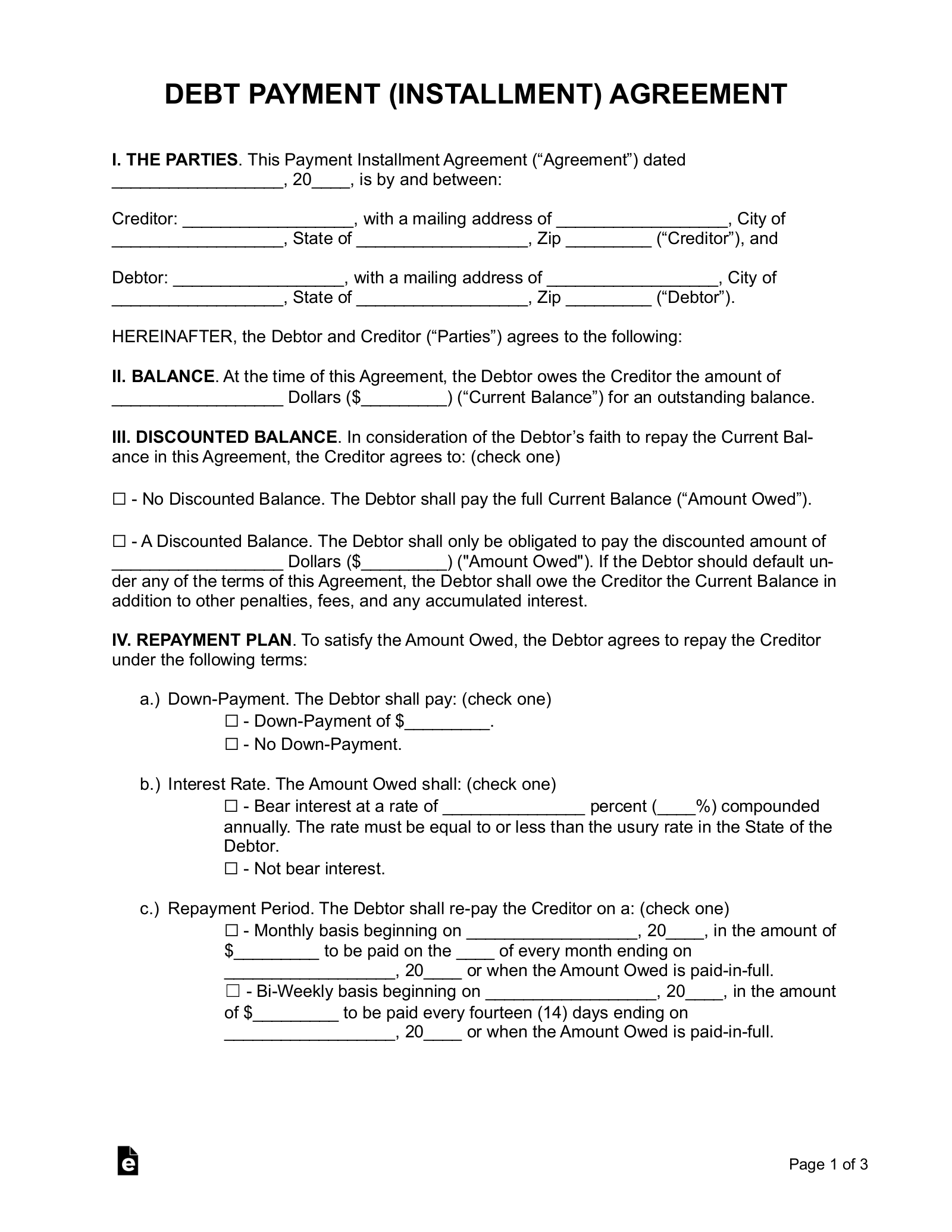

Web download the spreadsheet and follow the steps above to create your initial debt repayment plan. Keeping track of payments and balances is important, so download the free incharge debt reduction spreadsheet, which will help you calculate your repayments and keep track after you input your balances, interest and payments. Web see how we rate products and services to help you make smart decisions with your money. A payment agreement is a legally binding fillable contract between two parties (lender and borrower) mentioning a loan’s transaction details and terms and conditions of repayments.

Web Grab These Free Printable Debt Payoff Planner Pages To Help You Track As You Pay Down Your Debt So You Always Know Where You Stand With Your Finances.

We can’t help but recommend our own debt snowball worksheet ( you can download it for free here) as a great option if you’re looking to track your debt payoff journey. Web mrsneat® | printable and digital planner templates. Debt worksheet in finance organization kit. These spreadsheets work best with the debt snowball method.

All Pages Are 100% Free.

Automate both your minimum payments and the extra payment you’re making towards whichever debt you’re prioritizing first. A federal appeals court blocked the implementation of the biden administration's student debt relief plan, which would have lowered monthly payments for millions of borrowers. By having a structured plan, it is easier to keep up with payments, reduce interest, and ultimately get out of debt. First enter the current principal balance owed and its attached interest rate.