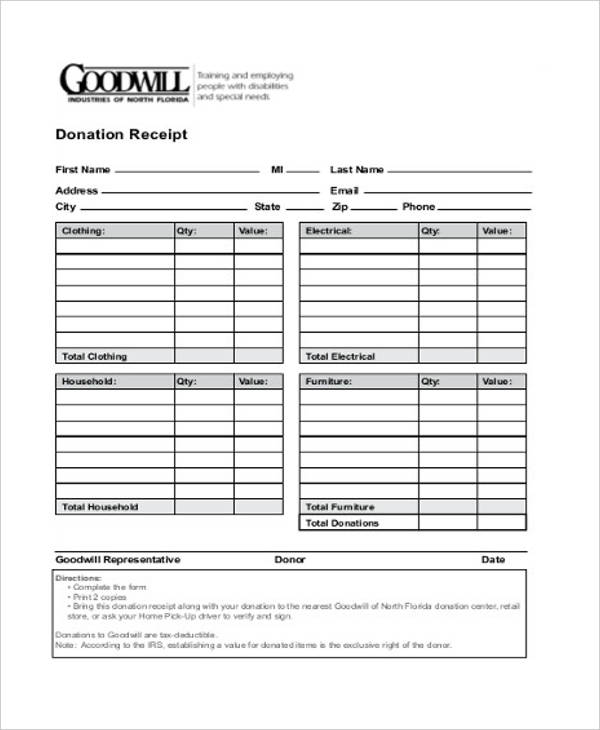

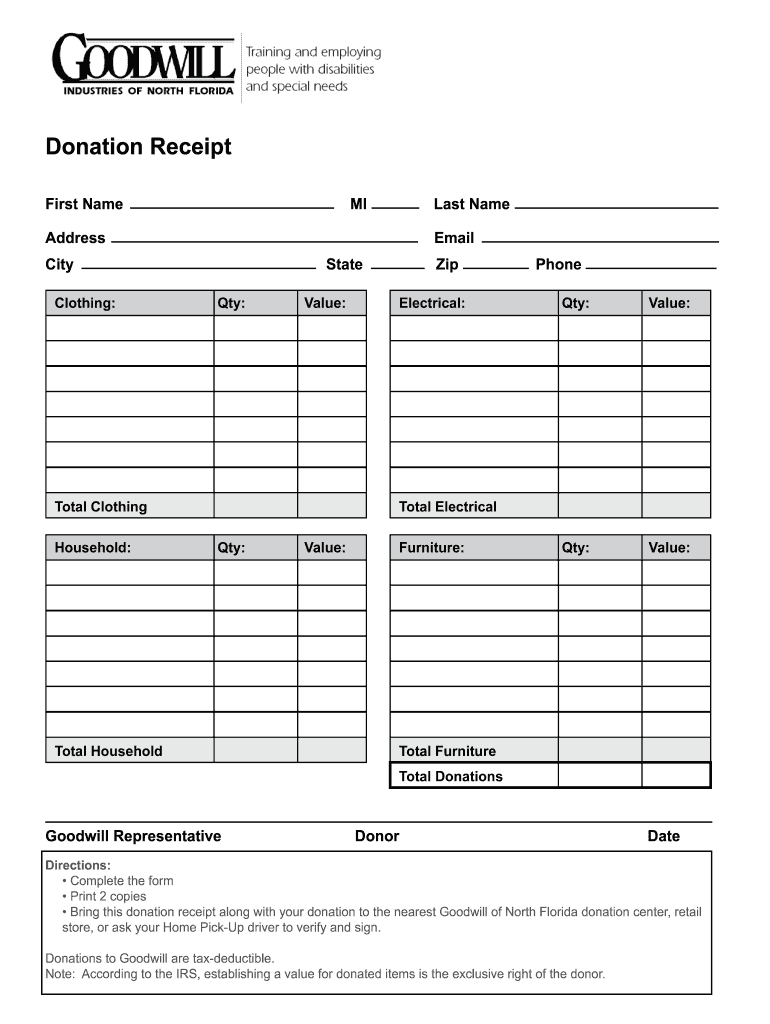

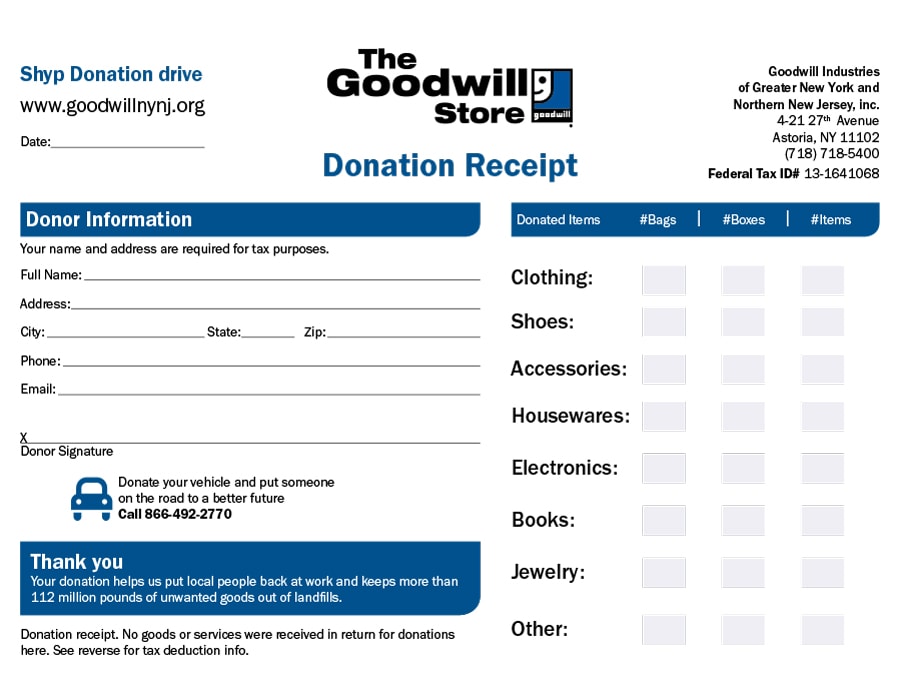

Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501 (c) (3) of the internal revenue code. Books, records, cds, videotapes, and dvds. Web donating to goodwill is easy! A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Prices are only estimated values.

We happily accept donations of new or gently used items, including: To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501 (c) (3) of the internal revenue code. Books, records, cds, videotapes, and dvds.

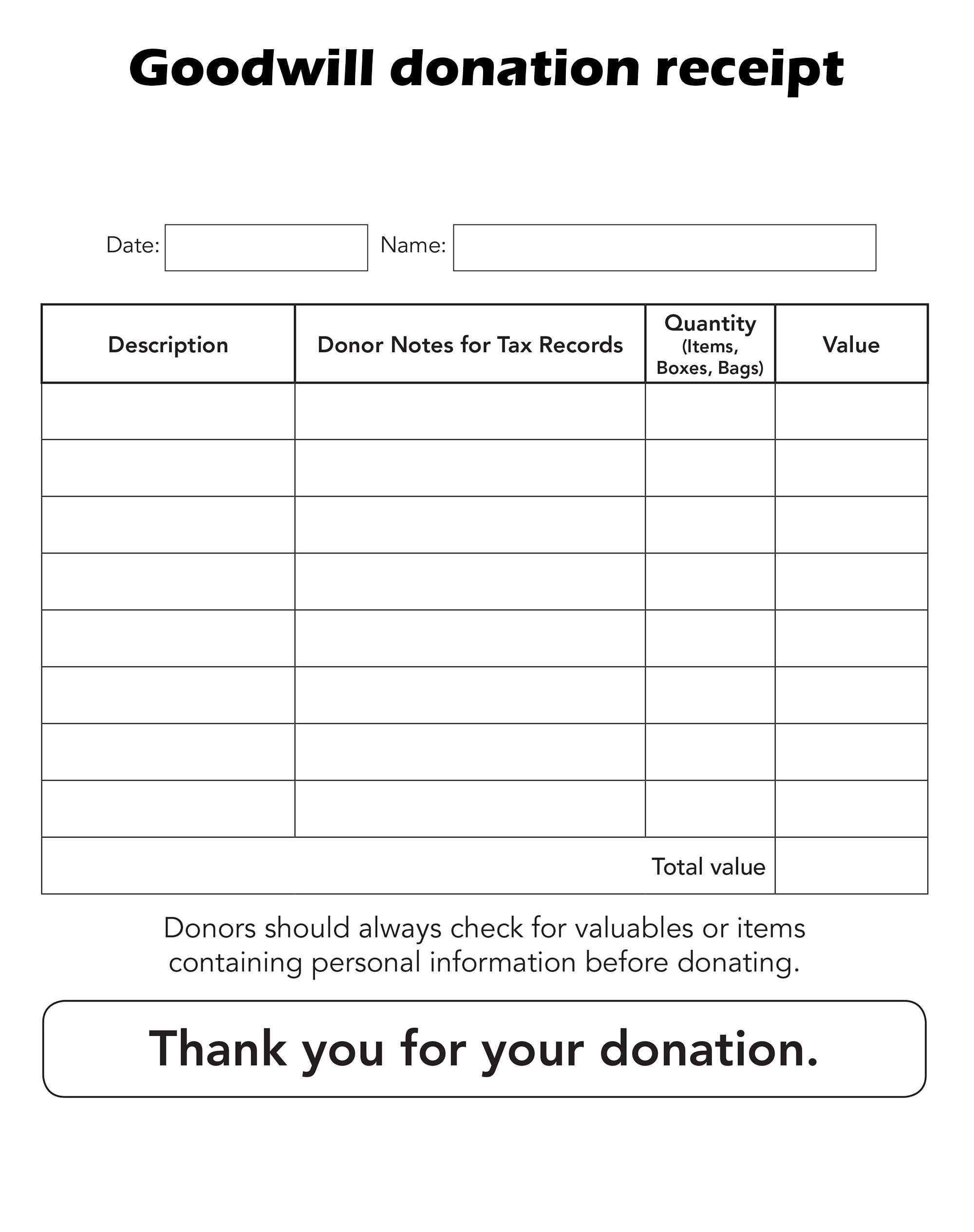

Web use the online donation receipt builder to track and keep important irs guidelines for your tax return after donating to goodwill. Internal revenue service (irs) requires donors to value their items. Assume the following items are in good condition, and remember: Goodwill has not provided any goods or. We happily accept donations of new or gently used items, including:

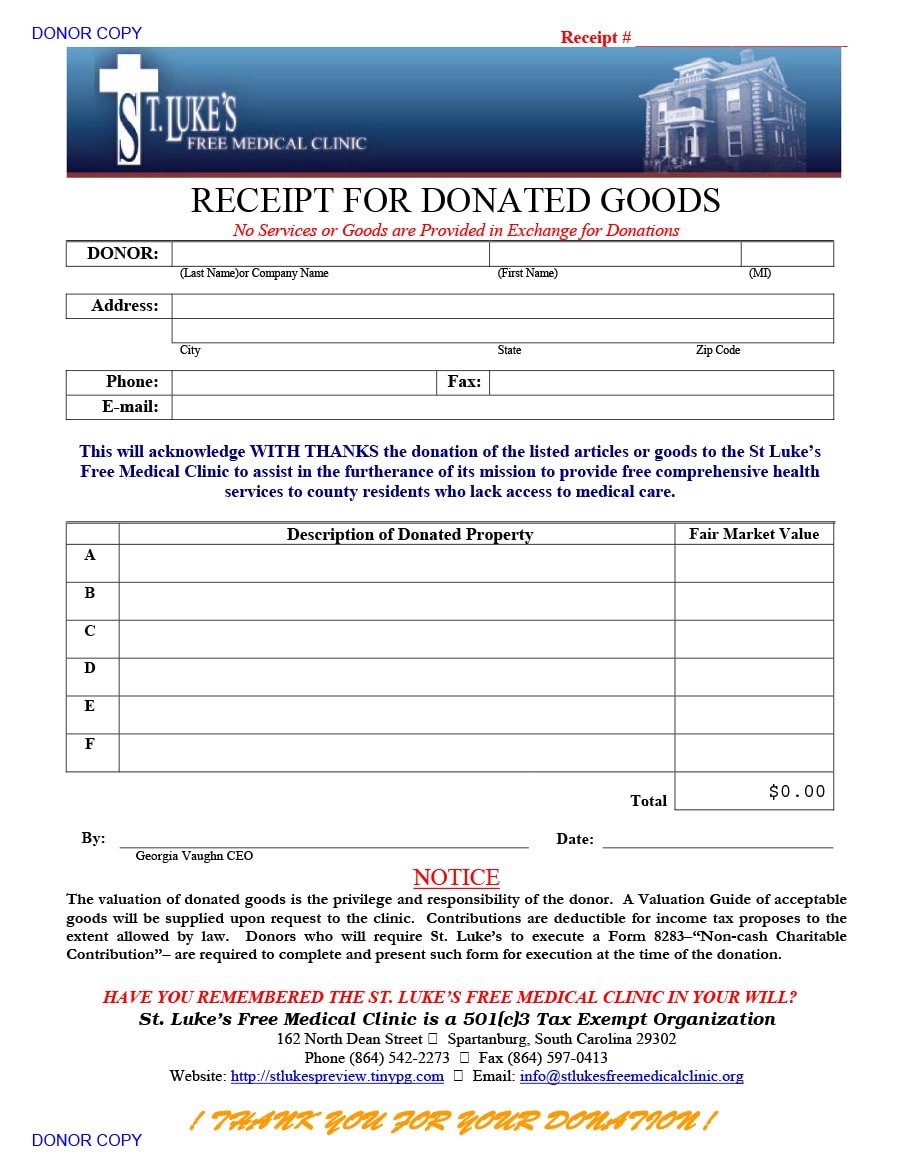

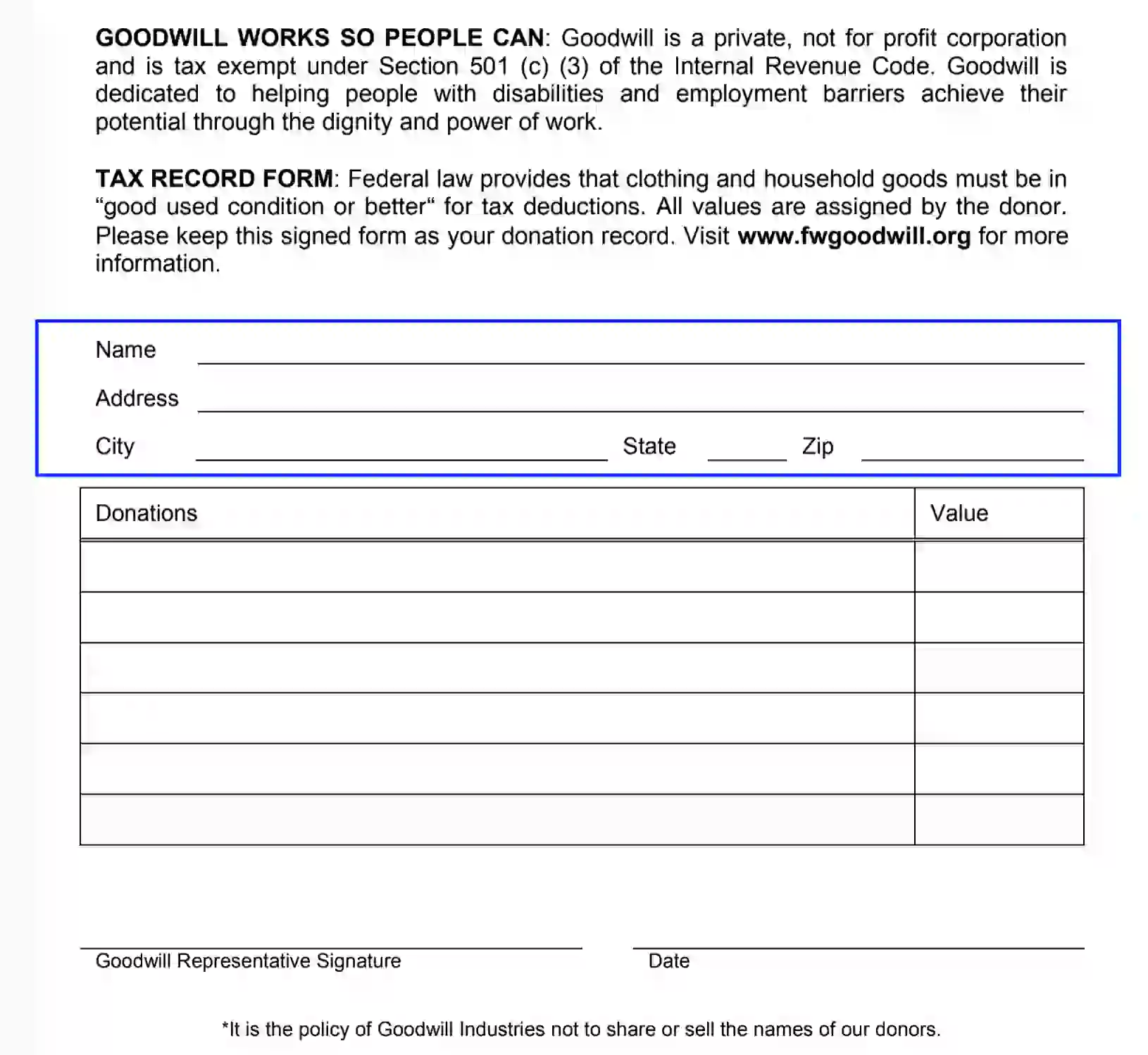

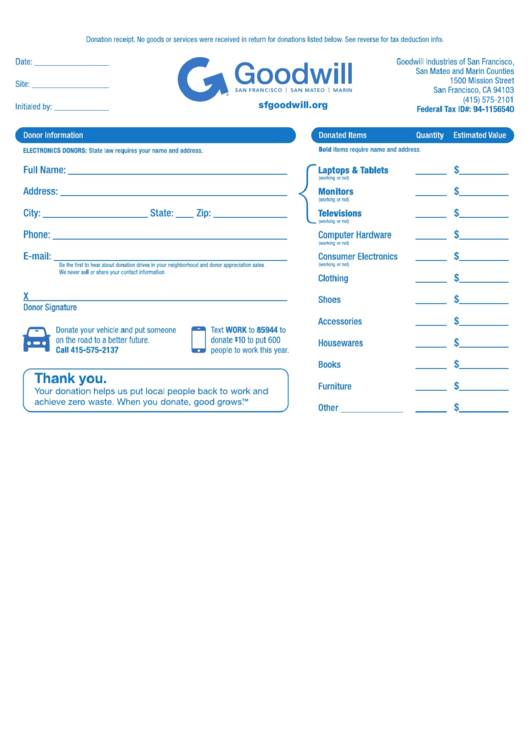

Find a donation center near you! Web use the online donation receipt builder to track and keep important irs guidelines for your tax return after donating to goodwill. Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501 (c) (3) of the internal revenue code. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Prices are only estimated values. Assume the following items are in good condition, and remember: Goods or services were not exchanged for this contribution and no personal benefit was incurred by it, so it is entirely deductible to the extent allowable by the law. Web goodwill donors the u.s. Internal revenue service (irs) requires donors to value their items. We happily accept donations of new or gently used items, including: Web donating to goodwill is easy! To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Housewares, dishes, glassware, and small appliances. This form is available at the time of donation from our stores and donation centers in maine, new hampshire and vermont. Goodwill has not provided any goods or.

Web Use The Online Donation Receipt Builder To Track And Keep Important Irs Guidelines For Your Tax Return After Donating To Goodwill.

Prices are only estimated values. Find a donation center near you! We happily accept donations of new or gently used items, including: To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores.

This Form Is Available At The Time Of Donation From Our Stores And Donation Centers In Maine, New Hampshire And Vermont.

Goodwill has not provided any goods or. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Goods or services were not exchanged for this contribution and no personal benefit was incurred by it, so it is entirely deductible to the extent allowable by the law. Internal revenue service (irs) requires donors to value their items.

Web Goodwill Donors The U.s.

Housewares, dishes, glassware, and small appliances. Web donating to goodwill is easy! Books, records, cds, videotapes, and dvds. Web download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501 (c) (3) of the internal revenue code.