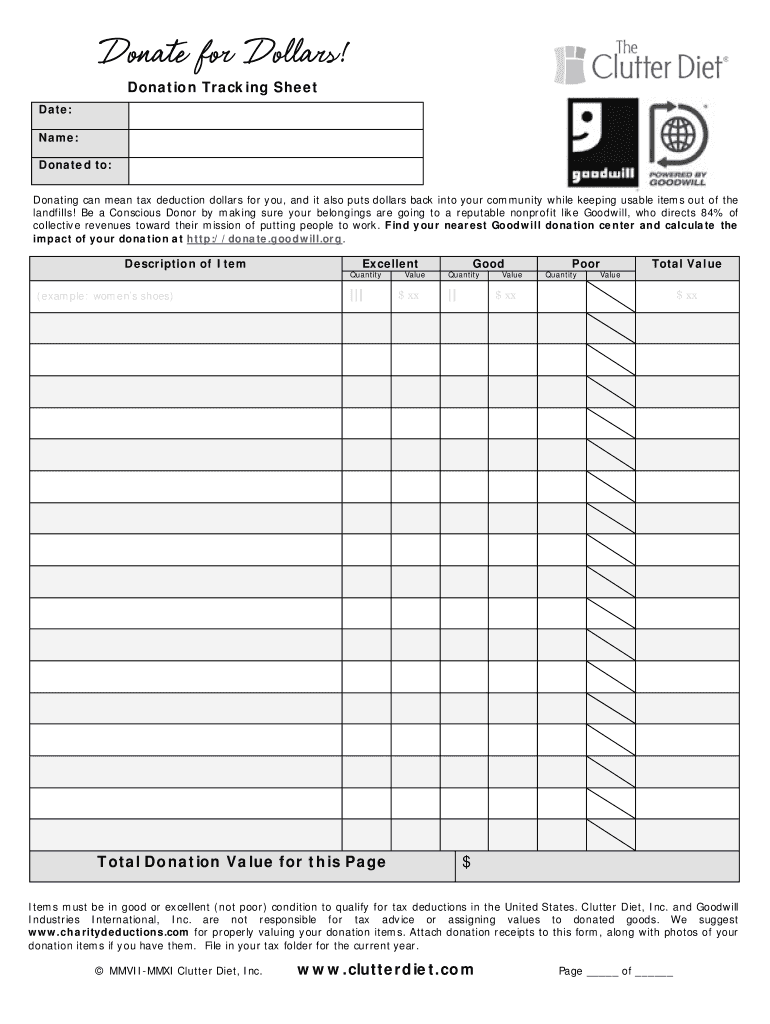

Web goodwill accepts gently used items that are clean, safe and resaleable. Your donations are changing the lives of people in your. A donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and. Simply enter the number of donated items into the form below to calculate. Clothing sleepwear children $1.50 clothing sleepwear men & women $2.99 clothing suit children $2.99 clothing suit men & women $9.99 clothing.

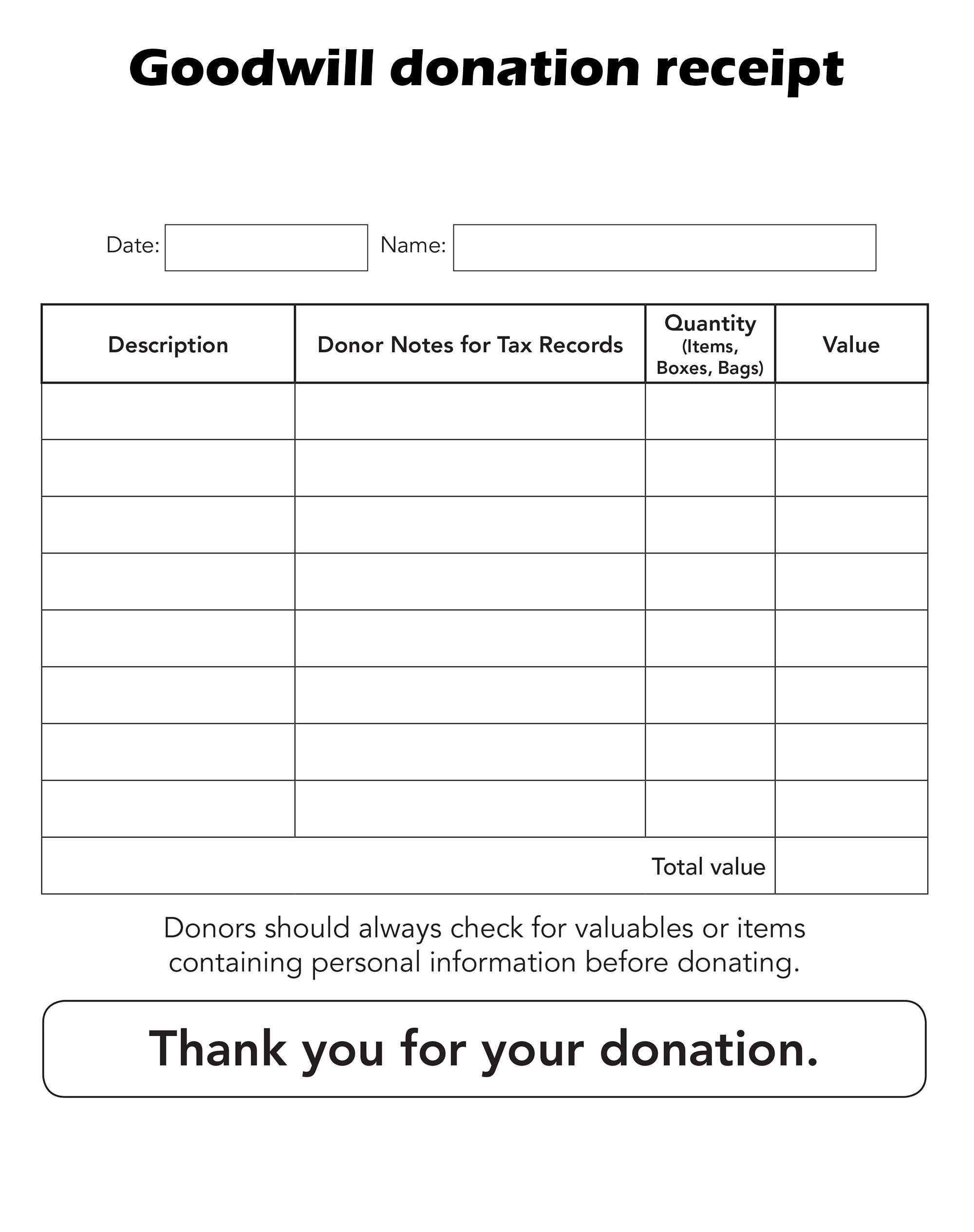

Thanks for donating to goodwill. Web estimate the value of your donations automatically with this handy donation calculator and receipt form. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. To determine the fair market value of an item not on this list below, use this calculator or 30% of the. Your donations are changing the lives of people in your.

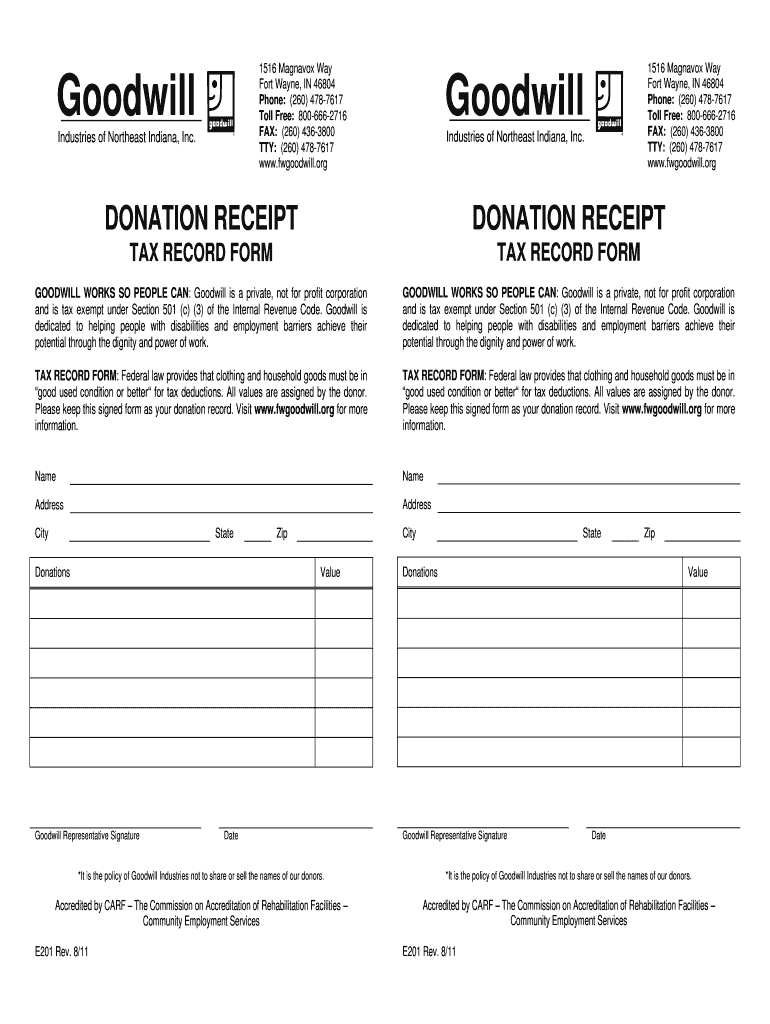

Web calculate the impact your donation will make on the community by using goodwill's used goods donation impact calculator. A donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and. Web to get started, download our donation valuation guide, which features estimates for the most commonly donated items. Web after you make a donation to goodwill, ask for a donation receipt. Please see the list of items.

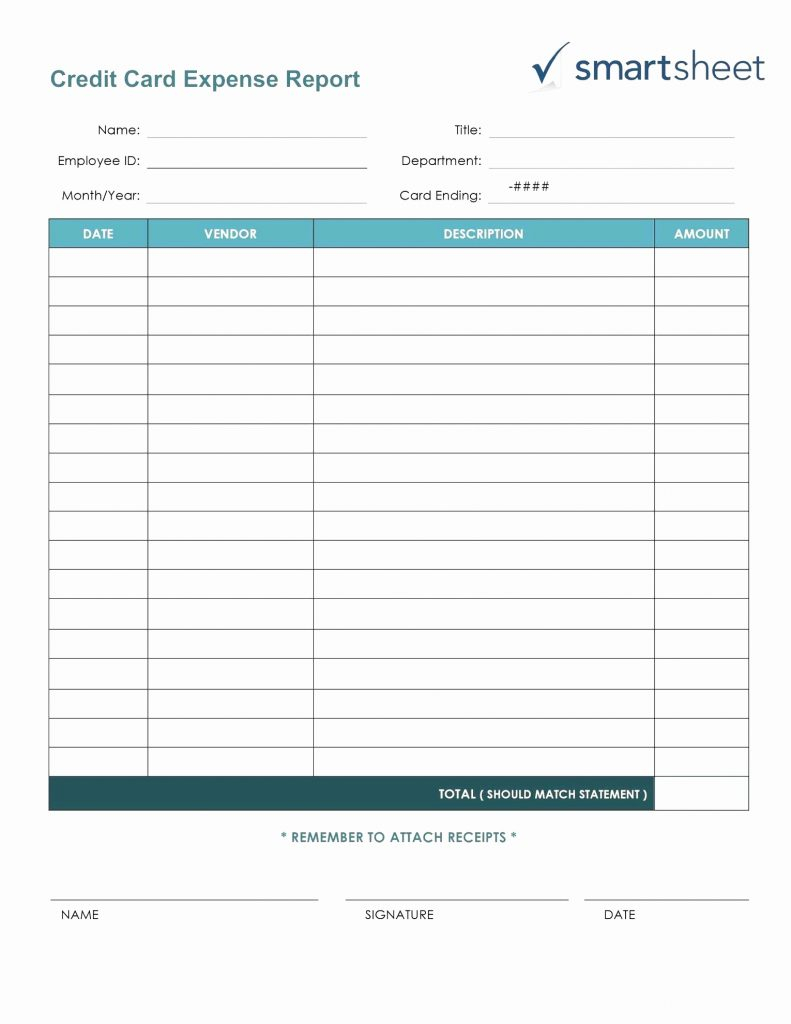

Web after you make a donation to goodwill, ask for a donation receipt. Donations can be made at our retail stores and attended donation centers. Thanks for donating to goodwill. According to the internal revenue. Interested in finding out where you can. View pricing detailscustomizable formschat support availablesearch forms by state Web the internal revenue service (irs) requires that all charitable donations be itemized and valued. Web calculate the impact your donation will make on the community by using goodwill's used goods donation impact calculator. A donation receipt is an itemized list of the items that you donated, that includes the item, fair market value, and. To help guide you, goodwill industries international has compiled a list providing price ranges. To help guide you, goodwill industries international has. Web goodwill accepts gently used items that are clean, safe and resaleable. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Web learn how to donate your gently used items to goodwill and support job training and placement programs. Web how to fill out a goodwill donation tax receipt.

View Pricing Detailscustomizable Formschat Support Availablesearch Forms By State

Find out how to get a donation receipt, what items to donate,. Simply enter the number of donated items into the form below to calculate. Interested in finding out where you can. Web to get started, download our donation valuation guide, which features estimates for the most commonly donated items.

Web The Internal Revenue Service (Irs) Requires That All Charitable Donations Be Itemized And Valued.

Web valuation guide for goodwill donors. To determine the fair market value of an item not on this list below, use this calculator or 30% of the. You, the donor, must determine the fair market value of those donations. Use the list below as a general guide to assess the “fair market value” you.

Internal Revenue Service (Irs) Requires Donors To Value Their Items To Obtain A Charitable Donations Itemized Tax Deduction.

Web goodwill accepts gently used items that are clean, safe and resaleable. According to the internal revenue. Web how to fill out a goodwill donation tax receipt. Often requested by goods donors for tax purposes.

A Donation Receipt Is An Itemized List Of The Items That You Donated, That Includes The Item, Fair Market Value, And.

Web after you make a donation to goodwill, ask for a donation receipt. Web guide for goodwill donors to estimate the value of their donation. Donations can be made at our retail stores and attended donation centers. Web estimate donation calculator if you itemize deductions on your federal tax return (using the long form), you are entitled to claim a charitable deduction for your donation to.