The trustee is responsible for safeguarding the trust’s assets during the grantor’s lifetime. Web a revocable living trust is a legal estate planning tool created by an individual (s) (the grantor) to hold their assets and property, and that designates who will receive the said assets and property upon the grantor’s death or incapacitation. A revocation must be in writing or in an. A living trust, also known as a revocable trust, is an agreement created by a person, known as the grantor, to hold some portion of their assets during their lifetime. All such assets and property transferred to this trust at any given time will be d.

It becomes effective soon after the grantor passes on without being subjected to the probate process in. It provides for payments of income for the grantor and the distribution of the remaining assets of the trust upon their death. Indicate the purpose of the trust. V amendment or revocationthe grantor expressly reserves the right to revoke or amend this trust at any time dur. A living trust, also known as a revocable trust, is an agreement created by a person, known as the grantor, to hold some portion of their assets during their lifetime.

Fill out the name and address of the person (or people) putting property into the trust. The trustee is responsible for safeguarding the trust’s assets during the grantor’s lifetime. A revocable living trust is the most commonly used of the two types of documents. The trust provides for payment of income to. Web a revocable living trust is a legal estate planning tool created by an individual (s) (the grantor) to hold their assets and property, and that designates who will receive the said assets and property upon the grantor’s death or incapacitation.

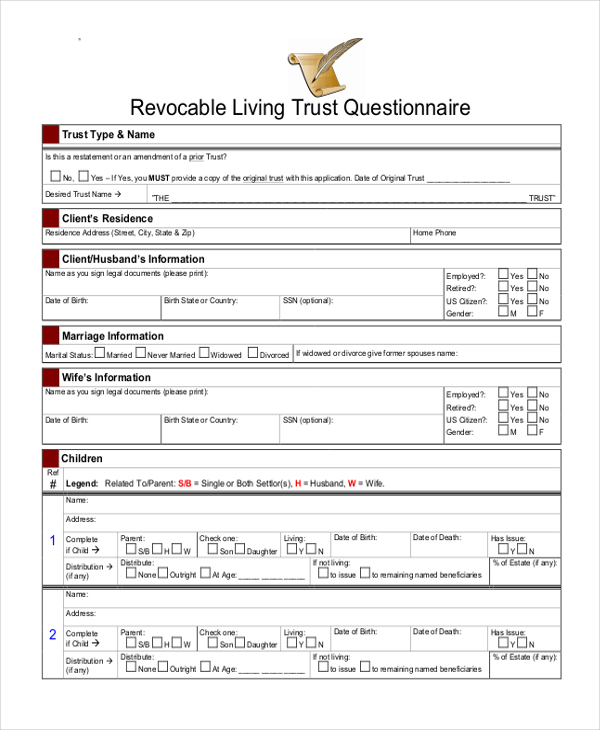

To set up a revocable living trust, follow these steps: Create a revocable living trust document. The reason being is that it can be modified at any moment. Within it, you must name a trustee, list beneficiaries, and list the assets you will place in the trust. It provides for payments of income for the grantor and the distribution of the remaining assets of the trust upon their death. A living trust, also known as a revocable trust, is an agreement created by a person, known as the grantor, to hold some portion of their assets during their lifetime. Web a living trust is a trust created by a person (the grantor) for use during that person's lifetime. Web the grantor to this trust. The trust’s assets will be transferred to the beneficiaries upon the grantor’s death. Fill out the grantor information. Web a living trust is a legal form that places your assets into a legal entity (a trust) to then be easily distributed to your heirs at the time of your death. Sign the document and get it notarized. Indicate the purpose of the trust. A revocable living trust is the most commonly used of the two types of documents. A typical irrevocable living trust form has its own tin that you may apply for with the irs.

It Also Includes An Option Which Allows The Grantor To Amend Or Revoke The Trust At Any Time.

Fill out the name and address of the person (or people) putting property into the trust. The trustee is responsible for safeguarding the trust’s assets during the grantor’s lifetime. There are two types of living trusts:. Create a revocable living trust document.

It Becomes Effective Soon After The Grantor Passes On Without Being Subjected To The Probate Process In.

Sign the document and get it notarized. A typical irrevocable living trust form has its own tin that you may apply for with the irs. To set up a revocable living trust, follow these steps: All such assets and property transferred to this trust at any given time will be d.

Web A Living Trust Is A Trust Created By A Person (The Grantor) For Use During That Person's Lifetime.

The trust’s assets will be transferred to the beneficiaries upon the grantor’s death. A living trust is a legal document that allows an individual (grantor) to place assets under the management of a trustee, who can be the grantor or another party. The term “revocable” means that a living trust can be amended or revoked at any given time by the grantor, and assets and property can be added. The most common reason for creating a trust is to manage and distribute your assets, but you can include any other lawful reason you choose.

Within It, You Must Name A Trustee, List Beneficiaries, And List The Assets You Will Place In The Trust.

Revocable this is the more popular of the two for the main reason that you can change the contents of the revocable living trust form at any given time. The reason being is that it can be modified at any moment. Web a revocable living trust is a legal estate planning tool created by an individual (s) (the grantor) to hold their assets and property, and that designates who will receive the said assets and property upon the grantor’s death or incapacitation. The trust provides for payment of income to.

![30 Free Living Trust Forms & Templates [Word] TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/12/living-trust-form-22-1183x1536.jpg)