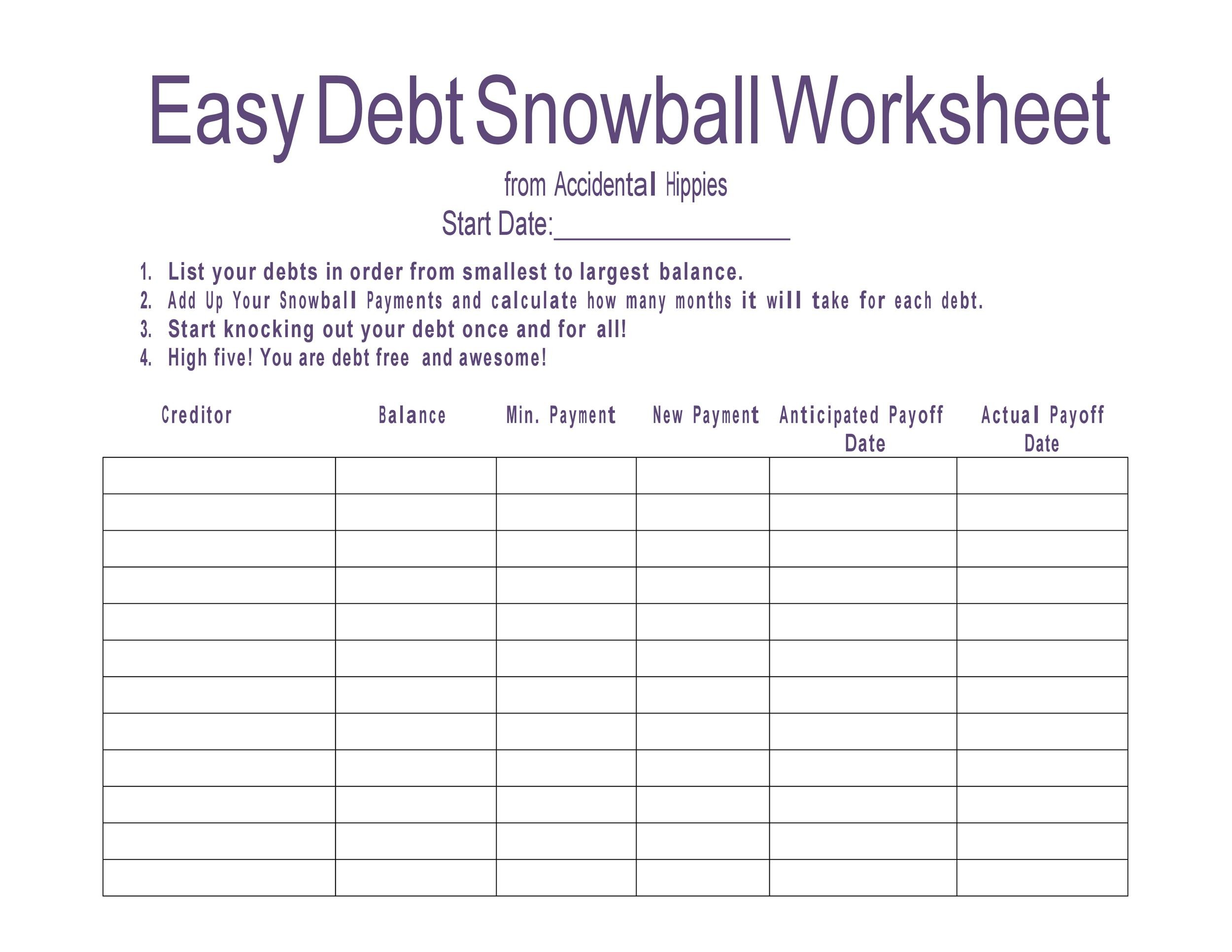

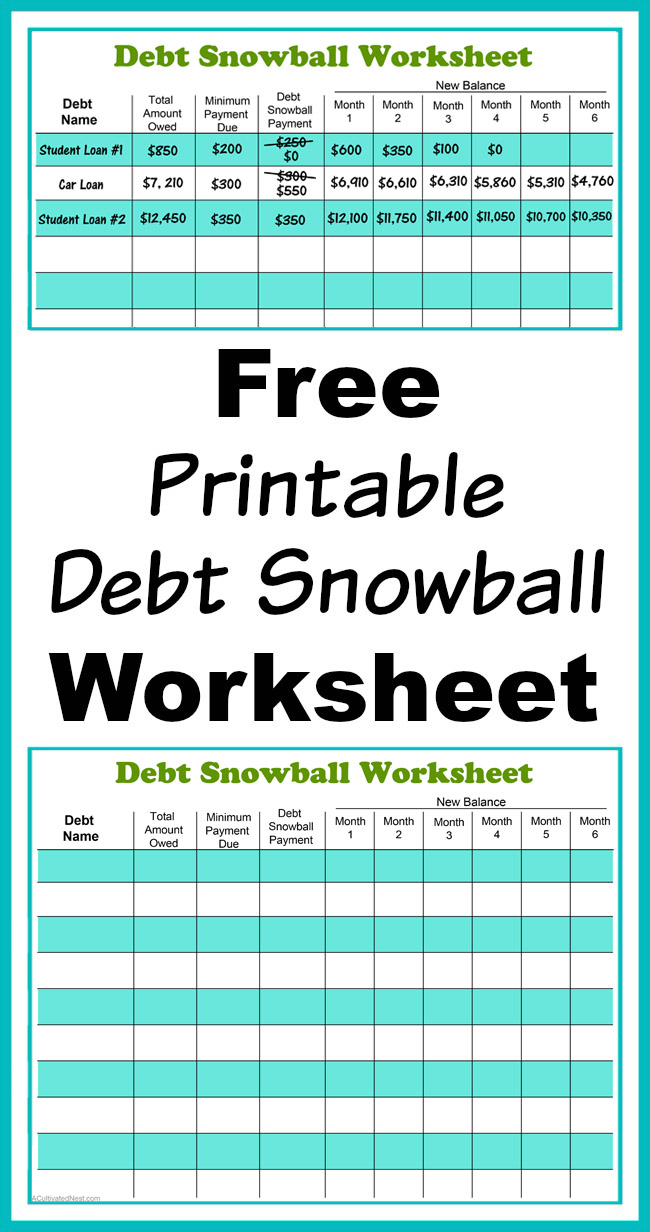

It contains some example figures to give you an idea of what to include. The debt snowball is one of the best ways to make a big dent in your outstanding debts. Take a look at your budget and see how much extra cash you can throw at your debt payoff each month. Just use a debt payoff spreadsheet or a debt snowball worksheet. On the worksheet, you will list your debt from the smallest balance to the largest.

Here’s how the debt snowball works: One of my favorite ways to tackle debt is with dave ramsey’s debt snowball method because it’s proven to work well when you have debt from multiple sources. If you prefer to use a spreadsheet to track your debt payoff progress, you can grab my debt payoff toolkit here. List down all your debts and arrange them from the biggest to the smallest. When you pay off the smallest debt, add that minimum payment amount to your next smallest debt payment.

It contains some example figures to give you an idea of what to include. This is the fun one! For beginners, we will also provide you with a simple, free debt tracker spreadsheet template to use. Once you’re ready, download our printable debt snowball worksheet and get started! J f m a m j j a s o n d.

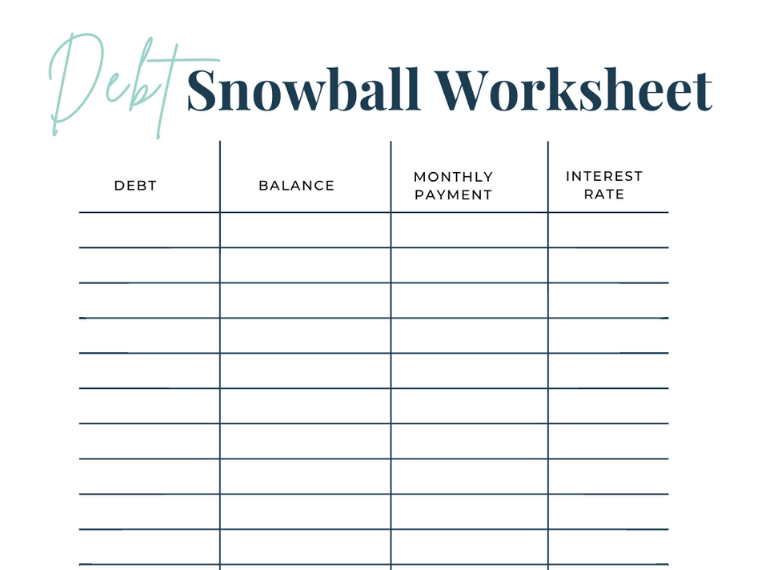

Use this debt snowball worksheet to stay organized and track the progress of your own debt payment. Using a debt snowball worksheet helps you prioritize your debts and figure out your debt payoff plan (you can download ours below). Here’s how the debt snowball works: List down all your debts and arrange them from the biggest to the smallest. Choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. This free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. Download this free debt snowball worksheet that will tell you exactly how many months until you are debt free once you fill it out. List all of your debts smallest to largest, and use this sheet to mark them off one by one. J f m a m j j a s o n d. On the worksheet, you will list your debt from the smallest balance to the largest. Get started with this free printable debt snowball worksheet! Fill out your debts from smallest to largest. The debt snowball is one of the best ways to make a big dent in your outstanding debts. Use it to automaticaly create a debt repayment plan using the debt snowball methods. Pay the minimum payment on every debt except the sma llest.

Use It To Automaticaly Create A Debt Repayment Plan Using The Debt Snowball Methods.

Here are 7 free debt snowball spreadsheets to help you save money, reduce stress, and avoid paying higher interest rates in 2023 with a plan to pay debt off. Download this free debt snowball worksheet that will tell you exactly how many months until you are debt free once you fill it out. It’s not a debt snowball calculator but a printable worksheet you can keep handy and use anytime to see how you’re doing paying off debt. For beginners, we will also provide you with a simple, free debt tracker spreadsheet template to use.

Pay The Minimum Amount Into.

Creditor starting balance minimum payment date payment balance creditor starting balance minimum payment date payment balance creditor starting balance Get started with this free printable debt snowball worksheet! Once you’re ready, download our printable debt snowball worksheet and get started! If you want a version you can edit, download the debt snowball spreadsheet instead.

Below Are 10 Debt Snowball Worksheets That You Can Download For Free To Use To Track Your Debt Payoff Process.

Pay as much money as possible to the smallest debt. J f m a m j j a s o n d. If you prefer to use a spreadsheet to track your debt payoff progress, you can grab my debt payoff toolkit here. Choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more.

Take A Look At Your Budget And See How Much Extra Cash You Can Throw At Your Debt Payoff Each Month.

All pages are 100% free. Download your free copy of our debt snowball worksheet. List all of your debts smallest to largest, and use this sheet to mark them off one by one. Fill out your debts from smallest to largest.